Welcome to the

Easiest & Most Profitable

Way To Provide Liquidity For The Vow Ecosystem

Liquidity Token Lessons

Learn how to create Pancake Swap Liquidity-Pair-Tokens (LP) manually or use the automatic alternative, which is up to 50x cheaper and faster.

Programmatically swap ETH, USDT or VOW, on either Ethereum or Binance blockchains, for Pancake Swap LP tokens which have been pre-created in a decentralized manner.

Swap ContractLearn how to get your own decentralized wallet, save your mnemonics and private keys, add custom token addresses and networks as well as connect your wallet to third party web apps such as Pancake Swap or Uniswap.

MetaMaskBuy your first cryptocurrency through any trusted third party payment processor. Follow the steps to see where you can avail yourself of these offerings and which tokens are available to buy with your bank card.

UniswapBecome an expert in no time by familiarizing yourself with the swap and send functions neccessary to trade and provide liquidity.

Import TokensLearn how to connect to Pancake Swap, add liquidity, manage your LP tokens, monitor your earnings & remove liquidity when you wish to have your assets returned.

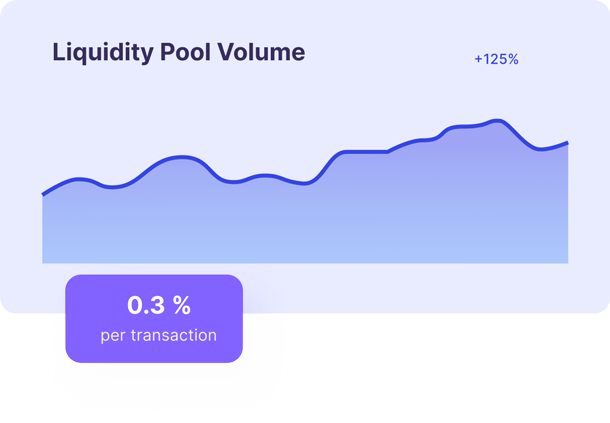

Liquidity PoolFAQs

Recieve your

Simply send USDT, ETH or VOW to the dedicated swap contract address and you will be returned Pancake Swap LP tokens of equivalent value automatically.

Let your tokens

Every time there is a trade on the VOW / vUSD liquidity pool you earn your proportional share from the transaction fees.

Connect to Pancake Swap to